Deep in Debt and on the Verge of Divorce? Why Filing Bankruptcy Prior to Splitting Can Be Better

Submitted by Rachel R on Fri, 12/06/2013 - 9:09pm

Bankruptcy prior to divorce is smarter.

Image source: EagleRockFinancial.net

As the saying goes, there can be no romance without finance. And in the case of divorce, even when the romance ends, the finances are still entangled. If you and your spouse are deep in debt - one of the leading factors in divorce – you need to consider how your debts will affect you after the dissolution of the marriage. If your debts are unmanageable now, they’ll likely be worse after the split. Bankruptcy prior to divorce can give you both a personal and financial fresh start after your split.

How Debt and Divorce Create Entanglements

In divorce, both spouses are responsible for debts accrued during the marriage. Since North Carolina is not a community property state, debts you’ve brought into the marriage such as student loans will likely remain yours after the breakup. But debts incurred during the marriage in only one name may be split equally if both parties benefitted. A credit card bill in your name that bought groceries for the family, clothing for the kids or to pay utilities will be split with your spouse. The court will also consider income and the higher earner will probably be assigned a proportionally higher share of the debt.

Divorce Decrees versus Creditor Obligations

It’s important to understand that the divorce decree won’t matter to the creditor. Whoever’s name is on the financing agreement is who the creditors will pursue. If both your names are listed, you are both equally able to be pursued for collections if the debt goes bad, even if only one of you is assigned the debt in the divorce. And if yours is the only name on the debt, but it was assigned to your spouse in the divorce, the outcome can be even worse for you. It’s important to understand that there can be two sets of legal liabilities related to debt – contractual liability and the liability from the divorce court.

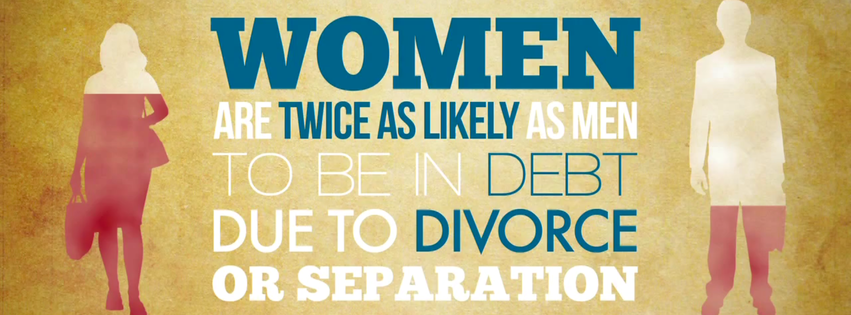

Women often suffer financially after a breakup.

Image source: MoneyAware.co.uk

Debts Get Worse After Divorce, Not Better

If your spouse doesn’t pay a debt you signed for that the court ordered them to, your credit will take a beating and you’ll have to go back to divorce court to pursue a complaint for their non-payment. It’s important to know that if you can’t service your debts with two incomes and expenses for only one household, you’ll be less likely to afford them after the split. You’ll be dealing with double the living expenses because you won’t have a spouse bringing in wages and this can tip you from barely getting by into not getting by at all.

Why Bankruptcy Prior to Divorce Is Preferable

If your debts are insurmountable, divorce won’t make this better and you could end up in bankruptcy afterward. This will take care of the debts in your name, but those that are in both names can be pursued against the other party. This can make your split nastier and if kids are involved can create a mess and more money problems. But if you file for bankruptcy before you divorce, both you and your spouse can unload your debts. This will simplify the asset and liability division process in the divorce. You’ll also get better results because filing jointly will double your exemptions.

To find out if your debt situation and impending breakup will be best served by a pre-divorce bankruptcy, consult an experienced North Carolina bankruptcy attorney for advice. The law office of John T Orcutt is ready to help you. Contact us now for a free consultation.

Debts Hurt! Got debt? Need help? Get started below!

Serving All of North Carolina

- Bankruptcy Attorneys Raleigh NC (North)

- Bankruptcy Attorney Fayetteville NC

- Bankruptcy Attorney Durham NC

- Bankruptcy Attorneys Wilson NC

- Bankruptcy Attorneys Greensboro NC

- Bankruptcy Attorneys Southport NC

- Bankruptcy Attorneys Wilmington NC

Bankruptcy Attorneys Raleigh NC (North)

6616 Six Forks Rd #203 Raleigh, NC 27615 North Carolina

Tel: (919) 847-9750

Bankruptcy Attorney Fayetteville NC

2711 Breezewood Ave Fayetteville, NC 28303 North Carolina

Tel: (910) 323-2972

Bankruptcy Attorney Durham NC

1738 Hillandale Rd Suite D Durham, NC 27705 North Carolina

Tel: (919) 286-1695

Bankruptcy Attorneys Greensboro NC

2100 W Cornwallis Dr. STE O Greensboro, NC 27408 North Carolina

Tel: (336) 542-5993

Bankruptcy Attorneys Southport NC

116 N Howe St. Suite A Southport, NC 28461 North Carolina

Tel: (910) 218-8682

Bankruptcy Attorneys Wilmington NC

116 N. Howe Street, Suite A Southport, NC 28461 North Carolina

Tel: (910) 447-2987