Your Financial Autobiography: The Top 10 Info Items You’ll Need to File Bankruptcy

Submitted by Rachel R on Tue, 01/01/2013 - 5:58pm

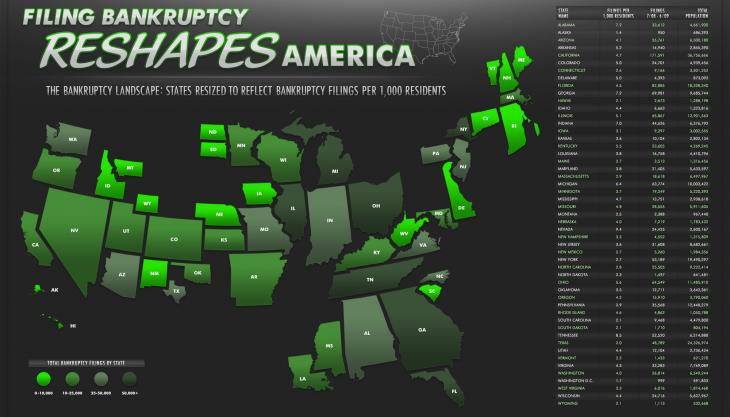

Image source: netdna-cdn.com

Filing bankruptcy can feel overwhelming, but some basic preparation on your part can not only help you feel in control, but speed up the process and reduce costs. The first step is simply making the decision to move forward with the proceedings. The second step is finding the right qualified bankruptcy attorney. When you’re ready for the first in-person meeting to review your financial situation, discuss options, and start the paperwork, having the right information prepared is critical. Here’s an overview of the information your attorney will need in order to get the bankruptcy process started.

The basics: You’ll need to provide your full legal name, your current residential address, social security number, maiden name if applicable, any previous addresses at which you lived during the last several years (exact dates of occupancy are important). Also list your spouse and any children you have with their ages, gender, and relevant information. A simple way to do this is to prepare a spreadsheet or word document listing the information.

Mortgage information: If you are a homeowner, you need to provide as much information about your home as possible, including first and/or second mortgages and home equity lines of credit. This information should include who holds the mortgage or credit line, account numbers and addresses, balances owed, date & amount of last payment, current market value of the home, if it is an individual or joint debt, and any liens or attachments and attorneys involved. You should also be prepared to discuss the important question of whether or not you want to try to keep the home or not through the homestead exemption.

Image source: Visual.ly

Bank accounts: List any and all bank accounts using the bank’s main office (not your local branch), what kind of account it is (including individual or joint and savings, checking, or cash deposit account) and how much money is currently in those accounts. You must also list any accounts that were closed in the last two years.

Vehicles: List all vehicles including cars, trucks, motorcycles, boats, and RVs. Give the year, make and model, date purchased/leased, if you owe money on it (how much, to whom, address, account number, joint or individual),date/amount last payment, mileage and description of vehicle, and the value if it were to be sold. Again, you need to decide if you are trying to retain these vehicles or not and be prepared to discuss those priorities with your attorney.

Other assets: Life insurance policies (term or whole life) and any cash value, all pensions, annuities, 401K plans, 403 B plans, etc. with complete address and account numbers. You must also list any accounts that were closed during the previous two years.

All other outstanding debts: List all taxes owed to any government, whether the IRS, state, city or town; any child support, alimony, amounts and arrearages, court ordered property settlements from a divorce, and any wages owed to employees if applicable. For other debts, list the creditor and its address and your account number, whether it is individual or joint, and collection agency contact information if applicable. It’s important to remember that not every debt is listed on your credit report.

Income information: List your gross pay and then list the amounts of all deductions (taxes, insurances, 401k, union dues, etc.) withheld and the purpose of the deductions. Include the name and address of your employer, position, and how long you’ve worked there. If you’re self-employed, include a copy of your federal Schedule C along with a Profit and Loss Statement covering the last 12 months and any 1099 forms received. Include the last two years of federal income taxes you filed and the last six months of all paycheck stubs.

Image source: Visual.ly

Monthly expenditures: Give as complete a picture as possible of what happens to your money each month – break your explanation down into categories such as housing, insurance, taxes, utilities, food, uncovered medical expenses, donations, clothing, transportation, pets, debt payments, and even gift giving and entertainment are allowable expenses if reasonable. It is very much in your favor to be as detailed as possible! Essentially, your expenses need to exceed your income, so be careful with this listing. A separate item related to expenses is to list each and every payment of $600 or more that you made to anyone during the last 90 days. It it looks like you’re unloading assets, it had better be to legitimate creditors!

Business interests: List any and all businesses or partnerships in which you have had any interest in the last six years with name, address, type and form of business, number of employees and dates of your involvement.

Finally, provide any pending lawsuits or legal actions you are involved in by listing the parties involved, explaining what the case is about, providing the contact information for your attorney if you have one, and any court information if available (docket number, name of court).

If you take the time to gather this documentation together and bring it to your first meeting with your chosen bankruptcy attorney, he or she will be impressed that you’ve taken the time to prepare. This will make the whole process start off on the right foot and result in a much smoother preparation for the actual filing.

Dedicated to helping residents of North Carolina find the best solutions to their debt problems. Don’t waste another day worrying about your debt. Call +1-833-627-0115 today to schedule a free initial consultation to discuss your bankruptcy options.

Debts Hurt! Got debt? Need help? Get started below!

Serving All of North Carolina

- Bankruptcy Attorneys Raleigh NC (North)

- Bankruptcy Attorney Fayetteville NC

- Bankruptcy Attorney Durham NC

- Bankruptcy Attorneys Wilson NC

- Bankruptcy Attorneys Greensboro NC

- Bankruptcy Attorneys Southport NC

- Bankruptcy Attorneys Wilmington NC

Bankruptcy Attorneys Raleigh NC (North)

6616 Six Forks Rd #203 Raleigh, NC 27615 North Carolina

Tel: (919) 847-9750

Bankruptcy Attorney Fayetteville NC

2711 Breezewood Ave Fayetteville, NC 28303 North Carolina

Tel: (910) 323-2972

Bankruptcy Attorney Durham NC

1738 Hillandale Rd Suite D Durham, NC 27705 North Carolina

Tel: (919) 286-1695

Bankruptcy Attorneys Greensboro NC

2100 W Cornwallis Dr. STE O Greensboro, NC 27408 North Carolina

Tel: (336) 542-5993

Bankruptcy Attorneys Southport NC

116 N Howe St. Suite A Southport, NC 28461 North Carolina

Tel: (910) 218-8682

Bankruptcy Attorneys Wilmington NC

116 N. Howe Street, Suite A Southport, NC 28461 North Carolina

Tel: (910) 447-2987