Business Bankruptcy Increasing – Personal Filings Down – Does Your Business Need Help?

Submitted by Rachel R on Wed, 06/01/2016 - 11:38am

Is your North Carolina business struggling?

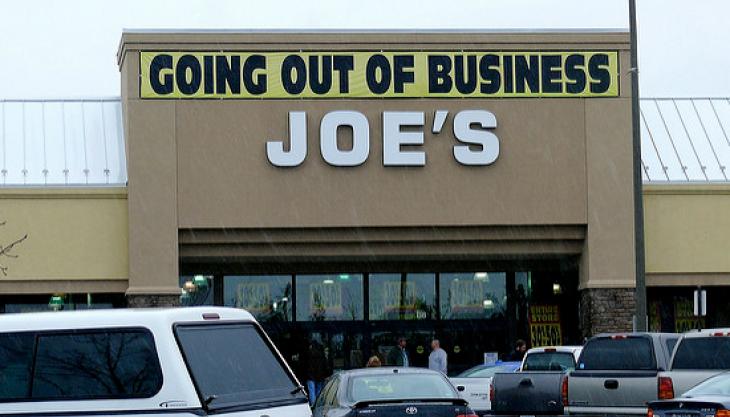

Image Source: Flickr CC User Larry & Teddy Page

New bankruptcy statistics were released recently from the American Bankruptcy Institute showing that from May 2015 to May 2016, business bankruptcies have increased a whopping 32%. And it’s not just May that was up – data shows that filings have been on the rise since November 2015.

Although business bankruptcy is up, overall bankruptcy is down which means that consumer bankruptcy filings (i.e. personal bankruptcy) are down. The businesses most likely to file for bankruptcy protection are in the energy and retail division, according to the latest statistics.

Data also shows that bankruptcy filings were highest, on a per capita basis, in Tennessee, Alabama, Georgia, Illinois, and Utah. The good news is that North Carolina did not make that top five list, but there are still businesses struggling with debt in our state.

What Can Business Bankruptcy Do for You?

If you’re a small business owner, Chapter 7 or Chapter 13 are the two chapters you would usually choose between when seeking bankruptcy protection. Here’s a quick look at the differences.

Chapter 7 small business bankruptcy facts:

- As a sole proprietor, you have to file a personal Chapter 7 since you and your business are one entity.

- If you're a small business owner who's not a sole proprietor, you may not need a personal Chapter 7.

- If you file personally, you'll wipe out both business and personal debts.

- NC bankruptcy exemptions can be used to shield personal and business assets to some extent.

- You can keep operating your sole proprietorship after the Chapter 7 or shut it down completely.

- If your biz is a partnership, LLC or corporation, Chapter 7 can effectively shut it down for you.

Chapter 13 small business bankruptcy facts:

- Sole proprietors can file Chapter 13 (other business models must use Chapter 11).

- Chapter 13 allows you to get onto a repayment plan to catch up on past due obligations.

- So long as you make payments on time, you can usually keep your business assets.

- You can keep on running your business while you use the Chapter 13 plan to reorganize.

- You may be able to lower balances due or interest rates on some secured business loans.

- As a sole proprietor, this chapter can also help eliminate or lessen personal debts.

What Are the Downsides of Business Bankruptcy?

While both Chapter 7 and Chapter 13 offer benefits to sole proprietors struggling to keep their businesses afloat, there are also downsides. Here’s a look at the drawbacks for each chapter.

Chapter 7 small business bankruptcy disadvantages:

- Personal Chapter 7 only helps with business debts if you’re a sole proprietor.

- Chapter 7 only offers asset exemptions to assets in your personal name, not a corporate name.

- Business debts in your name won’t be discharged unless you file personal Chapter 7.

Chapter 13 small business bankruptcy disadvantages:

- LLCs, partnerships and corporations cannot use Chapter 13.

- Chapter 13 takes years to complete.

- Assets not covered by exemptions may increase plan payments if you want to keep them.

When Can a Business File Chapter 11?

Chapter 11 is the business bankruptcy chapter you usually hear about on the news when a big business is struggling or goes belly up. For instance, Sports Authority is in Chapter 11 right now, and Blockbuster Video went through it.

Chapter 11 is used by corporations, LLCs and partnerships that want to try and stay in business but need help dealing with their debt. The business continues to operate and makes payments on a plan to meet creditor obligations. This is called a “reorganization.”

If the company cannot keep up with payment plans, or it becomes obvious that there’s no way to salvage the business, Chapter 11 can be converted to a corporate Chapter 7 to shut the business down, liquidate assets and pay off creditors according to their priority and to the extent possible.

Is Your North Carolina Business Struggling?

If you own a small business and you’re struggling, come in for a free North Carolina business bankruptcy consultation at the Law Offices of John T Orcutt. Call +1-833-627-0115 now for a free no-obligation appointment at one of our locations in Raleigh, Durham, Fayetteville, Wilson, Greensboro or Wilmington.

We can take a look at your business income, assets and liabilities and let you know if bankruptcy is an effective option for your business or you personally and, if so, which chapter might be best and how it will affect you personally and professionally.

Debts Hurt! Got debt? Need help? Get started below!

Serving All of North Carolina

- Bankruptcy Attorneys Raleigh NC (North)

- Bankruptcy Attorney Fayetteville NC

- Bankruptcy Attorney Durham NC

- Bankruptcy Attorneys Wilson NC

- Bankruptcy Attorneys Greensboro NC

- Bankruptcy Attorneys Southport NC

- Bankruptcy Attorneys Wilmington NC

Bankruptcy Attorneys Raleigh NC (North)

6616 Six Forks Rd #203 Raleigh, NC 27615 North Carolina

Tel: (919) 847-9750

Bankruptcy Attorney Fayetteville NC

2711 Breezewood Ave Fayetteville, NC 28303 North Carolina

Tel: (910) 323-2972

Bankruptcy Attorney Durham NC

1738 Hillandale Rd Suite D Durham, NC 27705 North Carolina

Tel: (919) 286-1695

Bankruptcy Attorneys Greensboro NC

2100 W Cornwallis Dr. STE O Greensboro, NC 27408 North Carolina

Tel: (336) 542-5993

Bankruptcy Attorneys Southport NC

116 N Howe St. Suite A Southport, NC 28461 North Carolina

Tel: (910) 218-8682

Bankruptcy Attorneys Wilmington NC

116 N. Howe Street, Suite A Southport, NC 28461 North Carolina

Tel: (910) 447-2987