Can You Discharge Your Student Loans in Bankruptcy? You May Be Surprised at the Answer

Submitted by Rachel R on Mon, 01/18/2016 - 1:52pm

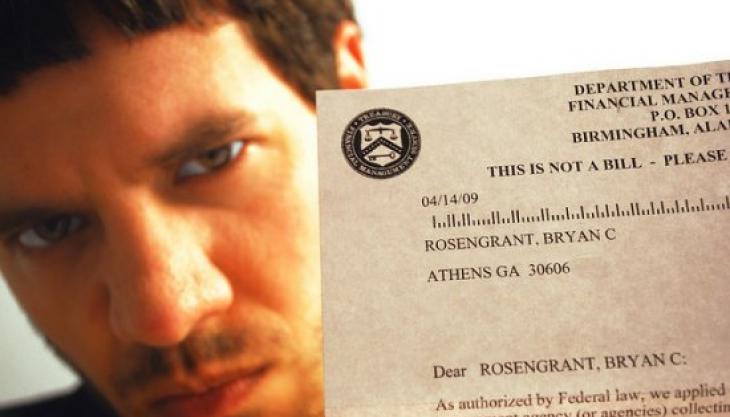

You may be able to get student loan help in bankruptcy

Image Source: Flickr User B Rosen

Doom and gloom stories in the press indicate that you simply cannot discharge student loans in bankruptcy. We’ve all seen the horror stories like a cancer patient being told that they should get back to work and pay their college debts or a permanently disabled person being denied a discharge despite the fact that they cannot work.

While these cases do exist, they are not necessarily the norm – and does not mean that you cannot get some relief from your student loan debt through bankruptcy. You may be surprised to know that the primary driver in debtors NOT getting student loans discharged as part of their bankruptcy case is because they don’t ask for it.

How to get student loans discharged in bankruptcy

First, you should know that student loans are handled differently in bankruptcy. You can’t simply just list them on your petition with your other debts and hope they get discharged. You have to file what’s called an “adversary proceeding” to request a discharge. This is like a separate mini-lawsuit where you’re suing the creditor in an attempt to get the debt forgiven because you can’t afford to pay.

This is outside of your normal bankruptcy process – and so will cost extra money for your attorney to file – but it may be well worth the effort. Did you know that less than one-tenth of one percent of bankruptcy filers with student loans even ask for relief of their student loans in bankruptcy? And of those that do ask, 50% of them get some measure of relief on this debt.

What relief can you expect from the bankruptcy court on student loans?

First, if paying your student loans is more an inconvenience than a hardship, you likely won’t get any relief. You have to prove what’s called “undue hardship” - a term that has never been defined even though it is part of the law surrounding student loans. In essence, the court has to balance between the needs of the taxpayers that loaned you the money to go to school versus your ability to pay.

Undue hardship is a gray area. If paying your student loans means you go without food, medical care, or cannot support your family at a basic level, you may be able to argue hardship. If you have a chronic medical condition or disability that keeps you from working at your capacity, that can be a good case for undue hardship. Every case will be different.

If you’re in a field where your earnings are low because of the nature of your job and will continue to be so such that your student loan debt is out of proportion to your ability to pay it, that can be an argument for undue hardship. And even though student loan payments can now be significantly reduced thanks to Income-Based Repayment or Pay As Your Earn, you may still be able to get a discharge.

The myth of student loan relief through IBR and PAYE

Both IBR and PAYE are income-sensitive options for lowering your student loan payments. In fact, these options can drop your payments down to as little as $0 a month depending on your income, family size, and other factors. However, the lower payments mean that your debt balance may mushroom. Interest will continue to accrue and what started as $30k of debt can balloon to $100k or more over time.

This is critical because, after 20-25 years of affordable payments under IBR or PAYE, the remaining loan balance can be discharged. That sounds great BUT the discharged amount if treated as taxable income. So in a couple of decades, you can be hit with a tax bill of $10k, $20k, $50k or more depending on how much debt is discharged thanks to IBR or PAYE.

If you can’t afford to pay your student loans, how can you afford to pay a lump sum tax bill that large. In short, you can’t. And this is an important part of an argument for discharge over forcing you into IBR or PAYE. The undue hardship of a sizeable tax bill can be a mitigating factor towards getting a discharge of student loans in bankruptcy.

Next steps

If your debts are so overwhelming that you’re living paycheck to paycheck, are dealing with constant debt collection calls and your life revolves around what you owe, you need an intervention. Bankruptcy can help you shed unsecured debts like medical bills, credit cards, and some past-due taxes – and may help with your student loans. Schedule an appointment with a bankruptcy attorney and be sure to ask them if they have experience with adversary proceedings.

Of the bankruptcy filers that asked for student loan relief, 50% were able to get some measure of help. Nearly 25% got total discharge of their Federal student loans; 15% got at least a partial discharge, and another 12% received an administrative remedy of some sort. There is hope to deal with student loans in bankruptcy, but the first step is to ask for the help you need.

If you live in North Carolina, contact the Law Offices of John T. Orcutt for a free North Carolina bankruptcy consultation. Call (code) to schedule a free appointment at one of our locations in (code).

Resources:

Student Loan Bankruptcy Study

Debts Hurt! Got debt? Need help? Get started below!

Serving All of North Carolina

- Bankruptcy Attorneys Raleigh NC (North)

- Bankruptcy Attorney Fayetteville NC

- Bankruptcy Attorney Durham NC

- Bankruptcy Attorneys Wilson NC

- Bankruptcy Attorneys Greensboro NC

- Bankruptcy Attorneys Southport NC

- Bankruptcy Attorneys Wilmington NC

Bankruptcy Attorneys Raleigh NC (North)

6616 Six Forks Rd #203 Raleigh, NC 27615 North Carolina

Tel: (919) 847-9750

Bankruptcy Attorney Fayetteville NC

2711 Breezewood Ave Fayetteville, NC 28303 North Carolina

Tel: (910) 323-2972

Bankruptcy Attorney Durham NC

1738 Hillandale Rd Suite D Durham, NC 27705 North Carolina

Tel: (919) 286-1695

Bankruptcy Attorneys Greensboro NC

2100 W Cornwallis Dr. STE O Greensboro, NC 27408 North Carolina

Tel: (336) 542-5993

Bankruptcy Attorneys Southport NC

116 N Howe St. Suite A Southport, NC 28461 North Carolina

Tel: (910) 218-8682

Bankruptcy Attorneys Wilmington NC

116 N. Howe Street, Suite A Southport, NC 28461 North Carolina

Tel: (910) 447-2987