Foreclosure In Raleigh: How a Bankruptcy Lawyer Can Save Your Home

Submitted by Rachel R on Tue, 01/15/2013 - 3:05pm

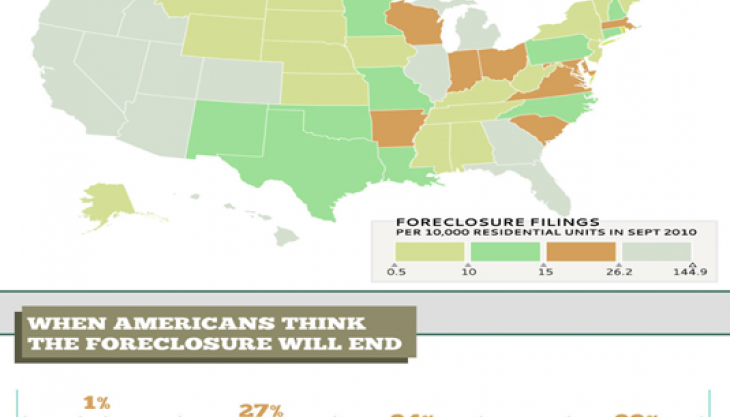

Raleigh, North Carolina, was hit particularly hard by the housing crisis. As the nation begins to slowly climb its way out of the most recent recession, the housing market has made significant recovery strides in many parts of the country. Raleigh, however, remains in a state of foreclosure crisis. According to Realty Trac, Raleigh ranks third on a list of 20 cities where the foreclosure rate remains high and is likely to increase in 2013. If you’re dangerously close to losing your home to foreclosure, a bankruptcy filing could let you keep your house. Here’s how it can work for you.

Even if the lender has started the foreclosure process, a bankruptcy filing stops it. The key is to make sure you file for bankruptcy before the final foreclosure deadline. As soon as the bankruptcy is filed, the mortgage lender must by law stop any pending foreclosure. This gives you some immediate breathing room to try and figure things out, and to take control of your situation. In North Carolina, the absolute final deadline to stop a foreclosure with a bankruptcy filing is the 10th day after the foreclosure sale. This differs from state to state, so if you’re not in North Carolina, find out what the deadline is in your own state. If you are facing foreclosure and want to use this bankruptcy to stall the process, it's important to contact a qualified local Raleigh bankruptcy attorney as soon as possible.

Image source: bankruptcy.me

But what kind of bankruptcy should you file? If you don’t have sufficient income to make good on your debts, then you should be filing a Chapter 7 bankruptcy. This will discharge all of your debts, but you can elect to try and keep your home. This is sometimes possible through federal and state “homestead exemptions” that protect set amounts of equity you’ve built up in your home. The federal exemption is around $21,000. The North Carolina exemption is higher, up to $35,000 in equity. What this means is that as long as the equity you’ve built up in your home is less than $35,000, you should be able to keep your home. In a Chapter 7 filing, however, if you have significantly more equity than that in your home, you could be forced to sell, in which case you would keep $35,000 and the rest would be distributed to your creditors. Either way, you’ll still need to make up any payments you’ve missed. The Chapter 7 bankruptcy buys you some time, but if your root problem is a lack of income, it’s not going to address that issue.

If you’re really trying to save your home from imminent foreclosure, the real question is this: If you were up-to-date on your mortgage, could you keep up with the payments? If so, then Chapter 13 is probably the surest way for you to file bankruptcy, stop the foreclosure, and keep your home. In a Chapter 13 filing, you don’t lose any property at all. Instead, you come up with a plan based on your income and expenses, to get current with your mortgage and other debt payments over a period of time. The back payments you owe on your mortgage can be spread out so you can get caught up while staying in your home. The payment plan will run anywhere from 3-5 years, and the bankruptcy trustees will first pay towards secured debts like your mortgage. After that they’ll start tackling unsecured debts like back income taxes. Other unsecured debt like credit cards and medical bills will be last on the list, and if the money runs low, those creditors will have to settle for whatever they get. Also, if the value of your home has dropped to less than you owe on the mortgage and you also have a home equity line of credit or second mortgage, the trustee might just entirely strip that away as unsecured debt.

Image source: bankruptcy.me

When it comes to trying to save your home from foreclosure, it may be your best option. If you're in this situation, contact us today to discuss your options.

Dedicated to helping residents of North Carolina find the best solutions to their debt problems. Don’t waste another day worrying about your debt. Call +1-833-627-0115 today to schedule a free initial consultation to discuss your bankruptcy options.

Debts Hurt! Got debt? Need help? Get started below!

Serving All of North Carolina

- Bankruptcy Attorneys Raleigh NC (North)

- Bankruptcy Attorney Fayetteville NC

- Bankruptcy Attorney Durham NC

- Bankruptcy Attorneys Wilson NC

- Bankruptcy Attorneys Greensboro NC

- Bankruptcy Attorneys Southport NC

- Bankruptcy Attorneys Wilmington NC

Bankruptcy Attorneys Raleigh NC (North)

6616 Six Forks Rd #203 Raleigh, NC 27615 North Carolina

Tel: (919) 847-9750

Bankruptcy Attorney Fayetteville NC

2711 Breezewood Ave Fayetteville, NC 28303 North Carolina

Tel: (910) 323-2972

Bankruptcy Attorney Durham NC

1738 Hillandale Rd Suite D Durham, NC 27705 North Carolina

Tel: (919) 286-1695

Bankruptcy Attorneys Greensboro NC

2100 W Cornwallis Dr. STE O Greensboro, NC 27408 North Carolina

Tel: (336) 542-5993

Bankruptcy Attorneys Southport NC

116 N Howe St. Suite A Southport, NC 28461 North Carolina

Tel: (910) 218-8682

Bankruptcy Attorneys Wilmington NC

116 N. Howe Street, Suite A Southport, NC 28461 North Carolina

Tel: (910) 447-2987