How to Manage Your Post Holiday Debt in 2013

Submitted by Rachel R on Thu, 01/03/2013 - 12:26pm

It’s a New Year, and with that comes a variety of financial resolutions. When we’re struggling with debt, we’re often dealing with financial issues that are longer standing. But you may find your financial position is actually worse after overspending and demands from the holidays. If you’re looking for smart ways to manage your holiday debt, here are four strategies to keep in mind.

It’s About Discipline. It’s easy to get caught up in the good feelings of the holidays and wind up over-spending, incurring more debt that isn’t helping improve your situation. The New Year presents a unique opportunity for you to resolve to be more disciplined in curbing your spending and saving more to pay off debts. Take another look at your regular spending habits and find places to make small cuts that will allow you to pay off the extra bills that have accumulated over the holiday season. What’s called for is a new level of strictness regarding your budget. It may be painful, but totally worth it in the long run.

Prioritize Bill Settlement. It will be very difficult to pay off substantial credit card debts if you only send the minimum payment due. Still, if you have a big stack of holiday bills, the first couple of months of the New Year might be the right time to strategically send in minimum payments to give yourself a little breathing room. After all, you need to keep the lights on and food on the table. Pay your utility bills first to avoid the headaches and hassles that can result if you don’t keep up with them. Then look for ways to prioritize debt repayment with the money you’re saving each month. Start with the smallest bills first in order to lower the number of creditors you’re dealing with and get some quick wins to keep you motivated.

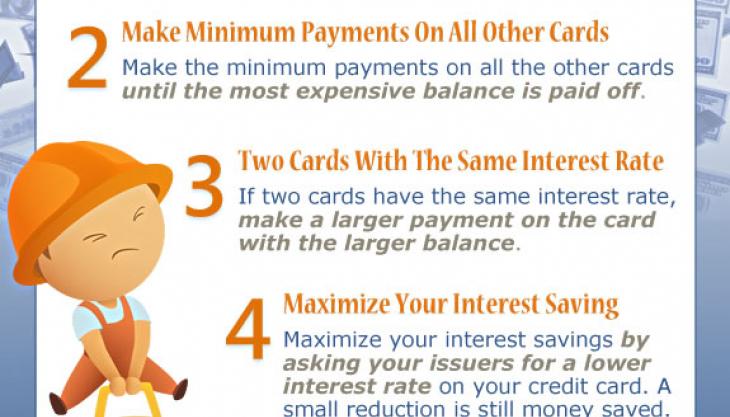

Image source: visual.ly

Increase Your Income. It may be time for you to seriously consider what you can do to generate extra income in order to pay off debts that have accumulated and worsened over the holidays. The beauty of the Digital Age is that there are lots of opportunities to put whatever skills you have to use by working online. Check out sites like Elance or oDesk. They both have a wide selection of categories in terms of work available, which means you’ll be more likely to find jobs that suit your skills. Set aside a couple of hours each night after the kids are in bed to develop your own sideline freelancing career. You will be pleasantly surprised how easy it is to generate significant extra income that will help you put your finances back on track in the New Year.

Live Within Your Means. If your credit cards represent a temptation you can’t seem to resist, cut them up and throw them away until your finances are back on track. Some creative people even freeze them in a block of ice. The plain fact of the matter is that you must learn to live within the income you can generate. Once your finances are back on track and you can pay off the balances each month, feel free to start using credit cards again, but use them strategically. Get cards that allow you to accumulate frequent flyer miles or other tangible benefits.

Image source: moneymanagement.org

Getting your finances back on track takes planning and commitment. It’s a simple matter of spending less and saving more to put towards debt payments. It’s important to acknowledge that sometimes this is not enough. If you’re struggling with how to manage your debt payments, talking to an experienced bankruptcy attorney can help you explore all of your options and choose the one that’s right for your situation. The knowledgeable bankruptcy professionals at the Law Offices of John T. Orcutt are here to help guide you on the path to regaining your financial footing.

Dedicated to helping residents of North Carolina find the best solutions to their debt problems. Don’t waste another day worrying about your debt. Call +1-833-627-0115 today to schedule a free initial consultation to discuss your bankruptcy options.

Debts Hurt! Got debt? Need help? Get started below!

Serving All of North Carolina

- Bankruptcy Attorneys Raleigh NC (North)

- Bankruptcy Attorney Fayetteville NC

- Bankruptcy Attorney Durham NC

- Bankruptcy Attorneys Wilson NC

- Bankruptcy Attorneys Greensboro NC

- Bankruptcy Attorneys Southport NC

- Bankruptcy Attorneys Wilmington NC

Bankruptcy Attorneys Raleigh NC (North)

6616 Six Forks Rd #203 Raleigh, NC 27615 North Carolina

Tel: (919) 847-9750

Bankruptcy Attorney Fayetteville NC

2711 Breezewood Ave Fayetteville, NC 28303 North Carolina

Tel: (910) 323-2972

Bankruptcy Attorney Durham NC

1738 Hillandale Rd Suite D Durham, NC 27705 North Carolina

Tel: (919) 286-1695

Bankruptcy Attorneys Greensboro NC

2100 W Cornwallis Dr. STE O Greensboro, NC 27408 North Carolina

Tel: (336) 542-5993

Bankruptcy Attorneys Southport NC

116 N Howe St. Suite A Southport, NC 28461 North Carolina

Tel: (910) 218-8682

Bankruptcy Attorneys Wilmington NC

116 N. Howe Street, Suite A Southport, NC 28461 North Carolina

Tel: (910) 447-2987