How to Plan for Bankruptcy: Rebuilding Your Credit After Filing

Submitted by Rachel R on Fri, 02/01/2013 - 10:34am

One of the persistent myths out there about declaring bankruptcy is that it ruins your chances of participating in the credit and loan markets for the foreseeable future. Nothing could be further from the truth! Yes, having a bankruptcy on your credit report is a red flag for many lenders. Realize first that it does go away, although it may take as long as 10 years. But even while your credit report shows a bankruptcy, you may be surprised how quickly you can re-establish a good credit history and get the loans and credit you need. Here are some things to keep in mind about different kinds of credit after bankruptcy.

Credit Cards. You can try applying for a regular credit card after bankruptcy, but for the first several years you’ll probably be declined. What you need to do is ease back into the credit card market with something called a secured credit card. What that means is that you put up an amount of cash to serve as collateral,which also becomes your credit limit on the card. If for some reason you default and don’t pay your balance, the cash is already there to pay it off. But remember, the point is to use the new card responsibly so you start building up a new, positive credit history. Be careful of cards that want to take advantage of you post-bankruptcy with outlandish fees, and make sure they will report to all three credit bureaus. Some don’t, which effectively defeats the purpose. Go with a major, reputable company and watch annual fees and interest rates.

Car Loans. The good news here is that after pulling back during the recession, auto lenders are already starting to get much more aggressive to issue new loans. They’re doing this in part by expanding their pool of potential applicants to include people with damaged credit. Because the loan is secured with the vehicle as collateral, you’ll actually find it easier to get a car loan than a regular credit card (which is unsecured). You’ll be able to get a car loan; it’s just a question of how high the interest rate will be or how much is required for a down payment. After a year or two of payments, your credit will be in better shape and you can try refinancing for a better rate. You might also explore the possibility of having a family member with good credit co-sign on the loan, which will greatly increase your chances of getting a good deal. Also see if you can go to the lender who did your last car loan if you made all the payments on time – that can also help since they know you and your history with them.

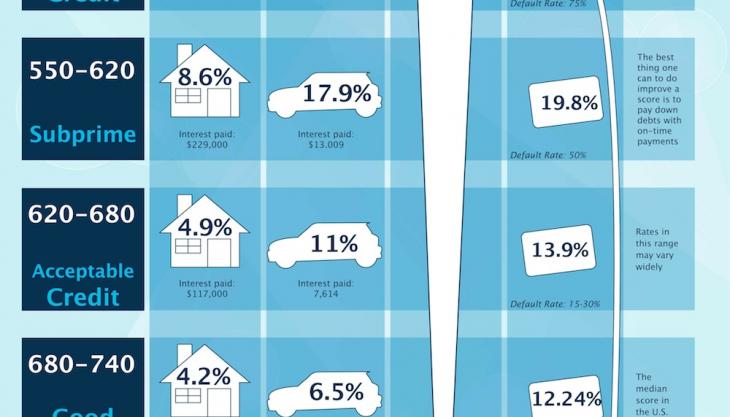

Image source: ericpetersautos.com

Mortgage Loans. This one is probably going to be the toughest one to figure out, but it can be done. The FHA (Federal Housing Administration) can allow a new mortgage two years after a Chapter 7 bankruptcy and just one year after a Chapter 13 filing. Fannie Mae and Freddie Mac guidelines, however, call for waiting two-four years. Since you know you’ll have to wait at least a year before you can even hope to qualify for a mortgage, spend that time wisely by rebuilding your credit. This involves paying ALL of your bills on time every month no matter what. Once that is a firm habit, apply for a secured credit card (see above) and then in time see if you can add in a small car loan as well. One you have a couple of years of good activity on these different forms of credit, you’ll have the necessary credit to qualify for a car loan.

Rebuilding your credit and accessing loans is possible after filing for bankruptcy. You will need to work hard and be disciplined in re-building your credit to be able to move past the bankruptcy. If you are facing financial hardship, schedule an initial consultation with a local qualified bankruptcy attorney today to learn more about your options.

Dedicated to helping residents of North Carolina find the best solutions to their debt problems. Don’t waste another day worrying about your debt. Call +1-833-627-0115 today to schedule a free initial consultation to discuss your bankruptcy options.

Debts Hurt! Got debt? Need help? Get started below!

Serving All of North Carolina

- Bankruptcy Attorneys Raleigh NC (North)

- Bankruptcy Attorney Fayetteville NC

- Bankruptcy Attorney Durham NC

- Bankruptcy Attorneys Wilson NC

- Bankruptcy Attorneys Greensboro NC

- Bankruptcy Attorneys Southport NC

- Bankruptcy Attorneys Wilmington NC

Bankruptcy Attorneys Raleigh NC (North)

6616 Six Forks Rd #203 Raleigh, NC 27615 North Carolina

Tel: (919) 847-9750

Bankruptcy Attorney Fayetteville NC

2711 Breezewood Ave Fayetteville, NC 28303 North Carolina

Tel: (910) 323-2972

Bankruptcy Attorney Durham NC

1738 Hillandale Rd Suite D Durham, NC 27705 North Carolina

Tel: (919) 286-1695

Bankruptcy Attorneys Greensboro NC

2100 W Cornwallis Dr. STE O Greensboro, NC 27408 North Carolina

Tel: (336) 542-5993

Bankruptcy Attorneys Southport NC

116 N Howe St. Suite A Southport, NC 28461 North Carolina

Tel: (910) 218-8682

Bankruptcy Attorneys Wilmington NC

116 N. Howe Street, Suite A Southport, NC 28461 North Carolina

Tel: (910) 447-2987