Mortgage Defaults Skyrocketing - HAMP Has Failed!

Submitted by Rachel R on Tue, 08/27/2013 - 10:54pm

Image source: HuffingtonPost.com

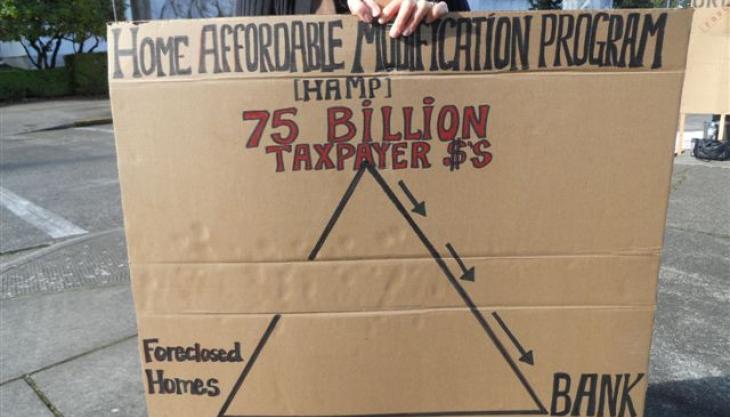

Remember 2009? The mortgage market was in a free fall, home values had plummeted leaving most upside down on their mortgages, the recession was peaking, unemployment was insane and we all thought (like Chicken Little) that the financial sky was falling. But then President Obama proposed a “game changing” solution and created the Home Affordable Modification Program (HAMP) intended to stem the tide of foreclosures and keep hard working Americans in their homes. The PR on the program was great, but now four years in, HAMP is circling the drain and mortgage defaults are rising.

Since it started in 2009, more than 865,000 homeowners have received mortgage modifications under HAMP that prevented them from going into foreclosure and has helped 910,000 overall. But since then, I’ve seen bankruptcy filings with HAMP modified mortgages rise and now there seems to be a virtual tsunami of mortgage failures that show HAMP has not proved to be a viable life raft for most.

Of the homeowners that sought foreclosure avoidance through HAMP, 306,000 are in default as of 2013 and another 88,000 are at risk and already one to two payments behind. These borrowers are on the fast track to foreclosure! Not only that, more than one million borrowers have flunked out of HAMP because they couldn’t make the supposedly “more affordable” payments the program offered from the get-go.

Image source: ColoradoIndependent.com

When HAMP was announced as part of the Troubled Asset Relief Program (TARP) – essentially the bank bailout – it promised to “help families keep their homes” but of the original loans modified under HAMP, 46% have redefaulted and this number is climbing. And length of time in the program is no barometer of success. In fact, the longer the borrower has been in HAMP, the more likely they are to default on their mortgage. Doesn’t sound like much of a solution to me…

When a homeowner in HAMP redefaults, not only do they lose their home but the taxpayers lose money invested in the program. That’s a lose-lose if ever there was one. A report from the Special Inspector General overseeing the program (SIGTARP) revealed in a recent report that these three characteristics indicate homeowners most likely to default:

(1) received the lowest reduction in monthly mortgage payment

(2) are upside down on their mortgage (i.e. owe more than the home is worth)

(3) had subprime (i.e. low) credit scores at the time they modified plus a high amount of debt

Image source: SIGTARP.gov

These three factors clearly indicate that HAMP wasn’t designed as a meaningful solution for troubled homeowners. Instead of tampering with interest rates (and not enough to make a significant dent in payments) financial experts say that reduction of principal would have been a better strategy to effect real change.

In North Carolina, there were 22,232 loan modifications made under HAMP. Of these, 6,617 (30%) have redefaulted on their mortgages. Just sixteen states have higher default rates than we have in our backyard. It’s too bad a mortgage cramdown isn’t available on mortgages for main residences to force subprime interest rates down to reasonable levels.

If you live in North Carolina and are behind on your mortgage payments, contact a reputable NC bankruptcy attorney like John T Orcutt for a free consultation on how bankruptcy can help you keep your home and avoid foreclosure. We have several convenient locations to choose from – contact us now for help keeping your home!

Debts Hurt! Got debt? Need help? Get started below!

Serving All of North Carolina

- Bankruptcy Attorneys Raleigh NC (North)

- Bankruptcy Attorney Fayetteville NC

- Bankruptcy Attorney Durham NC

- Bankruptcy Attorneys Wilson NC

- Bankruptcy Attorneys Greensboro NC

- Bankruptcy Attorneys Southport NC

- Bankruptcy Attorneys Wilmington NC

Bankruptcy Attorneys Raleigh NC (North)

6616 Six Forks Rd #203 Raleigh, NC 27615 North Carolina

Tel: (919) 847-9750

Bankruptcy Attorney Fayetteville NC

2711 Breezewood Ave Fayetteville, NC 28303 North Carolina

Tel: (910) 323-2972

Bankruptcy Attorney Durham NC

1738 Hillandale Rd Suite D Durham, NC 27705 North Carolina

Tel: (919) 286-1695

Bankruptcy Attorneys Greensboro NC

2100 W Cornwallis Dr. STE O Greensboro, NC 27408 North Carolina

Tel: (336) 542-5993

Bankruptcy Attorneys Southport NC

116 N Howe St. Suite A Southport, NC 28461 North Carolina

Tel: (910) 218-8682

Bankruptcy Attorneys Wilmington NC

116 N. Howe Street, Suite A Southport, NC 28461 North Carolina

Tel: (910) 447-2987