North Carolina Bankruptcy News: Ruling Shows Assets in Safe-Deposit Boxes Not Exempt

Submitted by Rachel R on Tue, 11/05/2013 - 9:58pm

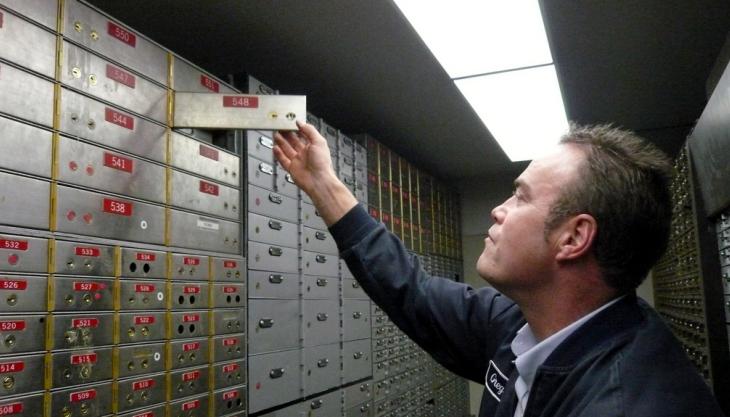

Image source: TheFunTimesGuide.com

If you keep valuables in a safe-deposit box at your bank, you must understand that these should be disclosed as part of either a chapter 7 or chapter 13 bankruptcy as assets the Trustee may consider for paying your creditors. While a reasonable amount of cash can be retained (around $5,000) for personal use, any excess (no matter where it’s kept) will likely be used by your Trustee to pay your debts.

In some cases, greater amounts of cash may be retained if they are already committed to debts such as attorney fees and are not intended to be retained personally. Two recent cases illustrate what can happen if cash is hidden in a safe deposit box during a bankruptcy filing. One of the cases seems to be more of an attempt to hide assets while the other seems to be an oversight rather than deliberate.

Wilkerson v. DeBaillon, Western District of Louisiana

Shannon Wilkerson filed for small business Chapter 11 protection in 2003 but the case was dismissed in 2005 without a discharge of debts being issued. Then he filed personal Chapter 7 bankruptcy in 2008 and received a discharge of debts in early 2009. Throughout both bankruptcies, it was later found, Wilkerson had a whopping $70,000 in a safe deposit box.

Image source: UBMich.com

The cash was discovered because he failed to pay the rent on the box and the bank drilled it open. When the bank found the cash, they reported the discovery and the information made it to the Trustee. Wilkerson claimed a mental condition was responsible for his failure to disclose but the court wasn’t swayed. His discharge was revoked and Wilkerson faced criminal fraud charges.

Calvin Phelps and Lisa Yamaoka Phelps, North Carolina

A NC bankruptcy judge ruled that a trustee could seize more than $100,000 from safe deposit boxes owned by the Phelps who in turn owned Renegade Tobacco. In 2010, the Phelps had to surrender personal property as part of a business bankruptcy to satisfy more than $8 million in business debts. Calvin Phelps is currently facing fraud charges unrelated to the bankruptcy due to a scheme to avoid tobacco liability payments.

When they filed bankruptcy, both the Phelps and the bank reported there was no cash in the safe deposit boxes but when they failed to pay rent, the banks opened the boxes and found more than $15,000 in the husband’s box and more than $88,000 in the wife’s. Yamaoka’s attorney tried to argue that she should be able to keep the money since it wasn’t a bank account and therefore not subject to garnishment. The court disagreed and the Trustee seized the funds.

Image source: Lostpedia.wikia.com

Final Thoughts

No matter where you stash your cash, you have to report it during your bankruptcy filing to avoid having your bankruptcy dismissed or facing criminal charges. If you have a significant amount of cash tucked away, it’s better spent on resolving your debt dilemma than trying to hide it away. If your debts are out of control and you need a solution, contact the law offices of John T Orcutt for a free consultation on filing North Carolina bankruptcy.

Debts Hurt! Got debt? Need help? Get started below!

Serving All of North Carolina

- Bankruptcy Attorneys Raleigh NC (North)

- Bankruptcy Attorney Fayetteville NC

- Bankruptcy Attorney Durham NC

- Bankruptcy Attorneys Wilson NC

- Bankruptcy Attorneys Greensboro NC

- Bankruptcy Attorneys Southport NC

- Bankruptcy Attorneys Wilmington NC

Bankruptcy Attorneys Raleigh NC (North)

6616 Six Forks Rd #203 Raleigh, NC 27615 North Carolina

Tel: (919) 847-9750

Bankruptcy Attorney Fayetteville NC

2711 Breezewood Ave Fayetteville, NC 28303 North Carolina

Tel: (910) 323-2972

Bankruptcy Attorney Durham NC

1738 Hillandale Rd Suite D Durham, NC 27705 North Carolina

Tel: (919) 286-1695

Bankruptcy Attorneys Greensboro NC

2100 W Cornwallis Dr. STE O Greensboro, NC 27408 North Carolina

Tel: (336) 542-5993

Bankruptcy Attorneys Southport NC

116 N Howe St. Suite A Southport, NC 28461 North Carolina

Tel: (910) 218-8682

Bankruptcy Attorneys Wilmington NC

116 N. Howe Street, Suite A Southport, NC 28461 North Carolina

Tel: (910) 447-2987