What Happens If You Lose Your Job During Chapter 13 Bankruptcy?

Submitted by Rachel R on Wed, 02/17/2016 - 9:42am

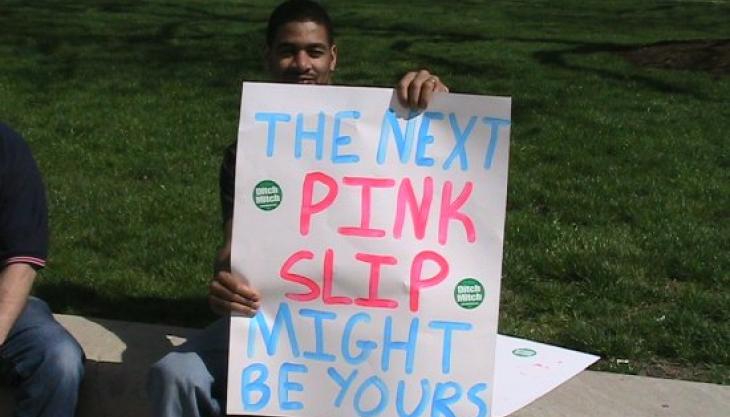

Lost your job? That could foul up your Chapter 13 bankruptcy

Image Souce: Flickr User Bernard Pollack

Chapter 13 bankruptcy plans require that you have a steady income coming in so that you can pay your living expenses, current installments on secured debt, and an additional amount towards past-due debts. But if you lose your job, it may be difficult, or impossible, to maintain plan payments. What then?

What are your options if you can’t afford your Chapter 13 payments?

If your money problems are short-term, you may be able to request a deferment of payments. But it’s best to address payment problems before you miss an installment. As soon as you realize you can’t afford an installment, you should speak to your attorney about your options.

Because every case is unique, there is no set answer to whether you can get a deferment or suspension of plan payments. Your attorney can file a motion to suspend or modify your Chapter 13 plan, and this should be done as soon as possible once you know there are problems.

You may be able to get approval to skip a few plan payments – although the plan would then be modified to add these months back on or change your total repayment plan. If you miss a payment without explanation, your Trustee can file a request to have your case dismissed.

Converting Chapter 13 to Chapter 7

If you signed on for a Chapter 13 bankruptcy because you earned too much to file Chapter 7, losing your job may turn out to be a positive thing regarding your debt. If you didn’t pass the Means Test before, you may after you lose your job and don’t have that source of income.

Your attorney can file to convert your Chapter 13 to Chapter 7 which will wipe out many of your unsecured debts including credit cards, medical bills, and some past-due taxes. This will lower the debts you need to service while you search for a job.

And once you find a new job, you can move on without a mountain of debt building up while you were job searching. However, you may want to wait to convert your Chapter 13 to a Chapter 7. Why? The Means Test looks back at your last six months’ worth of income.

Allow Your Chapter 13 to Be Dismissed Then File Chapter 7 Later

If you recently lost your job, your income may still seem too high for Chapter 7 Means Test purposes. But you can wait things out to get the best results. If you stop paying your Chapter 13 installments, your case will be dismissed, but then you can file a Chapter 7 later.

Waiting can also help you have a clean slate on debt when you do find a new job. If you convert to Chapter 7 right away then struggle to find a job, you may have debts accrue that will haunt you for longer. But if you wait, your average income will drop so you can qualify for Chapter 7.

Then any past-due debts that have piled up doing your unemployment can all be rolled up into your Chapter 7. If you were facing foreclosure or repossession and that’s why you filed Chapter 13, you will still have to deal with that issue, but job loss may have made these events inevitable.

Talk to a reputable North Carolina bankruptcy attorney

To find out the best options to deal with your debt – whether you’re employed, unemployed, job searching, or just found a new job – speak to a reputable North Carolina bankruptcy attorney. An experienced lawyer can assess your debt, income, assets and goals to best advise you.

Contact the Law Offices of John T. Orcutt for a free North Carolina bankruptcy consultation today. Call +1-833-627-0115 now for a free consultation in (cRaleigh, Durham, Fayetteville, Wilson, Greensboro or Wilmingtonode).

Debts Hurt! Got debt? Need help? Get started below!

Serving All of North Carolina

- Bankruptcy Attorneys Raleigh NC (North)

- Bankruptcy Attorney Fayetteville NC

- Bankruptcy Attorney Durham NC

- Bankruptcy Attorneys Wilson NC

- Bankruptcy Attorneys Greensboro NC

- Bankruptcy Attorneys Southport NC

- Bankruptcy Attorneys Wilmington NC

Bankruptcy Attorneys Raleigh NC (North)

6616 Six Forks Rd #203 Raleigh, NC 27615 North Carolina

Tel: (919) 847-9750

Bankruptcy Attorney Fayetteville NC

2711 Breezewood Ave Fayetteville, NC 28303 North Carolina

Tel: (910) 323-2972

Bankruptcy Attorney Durham NC

1738 Hillandale Rd Suite D Durham, NC 27705 North Carolina

Tel: (919) 286-1695

Bankruptcy Attorneys Greensboro NC

2100 W Cornwallis Dr. STE O Greensboro, NC 27408 North Carolina

Tel: (336) 542-5993

Bankruptcy Attorneys Southport NC

116 N Howe St. Suite A Southport, NC 28461 North Carolina

Tel: (910) 218-8682

Bankruptcy Attorneys Wilmington NC

116 N. Howe Street, Suite A Southport, NC 28461 North Carolina

Tel: (910) 447-2987