Will Filing Bankruptcy Discharge My Back Taxes?

Submitted by Rachel R on Wed, 01/23/2013 - 5:06pm

Two things are virtually certain in January in a large part of the country: snow and taxes. The post-holiday slump also brings in tax documents, from W2s from your employers to 1099s on banking and investments. The arrival of these documents raises a common question: If you are considering filing for bankruptcy, what implication does that have for any back taxes owed to the Internal Revenue Service (IRS)?

With the revisions that were made to bankruptcy laws in 2005, tax debt is treated the same way in both Chapter 7 and Chapter 13 bankruptcy filings. Remember that Chapter 7 results in the discharge of all allowable debts, while a Chapter 13 filing comes up with repayment plan for some debts and discharges others. Your tax debts might be discharged in bankruptcy according to a number of different criteria. Here’s a background overview on taxes and bankruptcy.

When the Return was Due. As you know, tax debt is specific to the tax return of a given year. To include tax debt in your bankruptcy filing, it must be for taxes on a return that was due at least three years before the date you file, including any extensions received. For example, let’s say you owed $5,000 on your 2009 tax return. Because the return was DUE on April 15, 2010, the earliest date that the tax debt could be included in a bankruptcy would be more than three years later, or April 16, 2013.

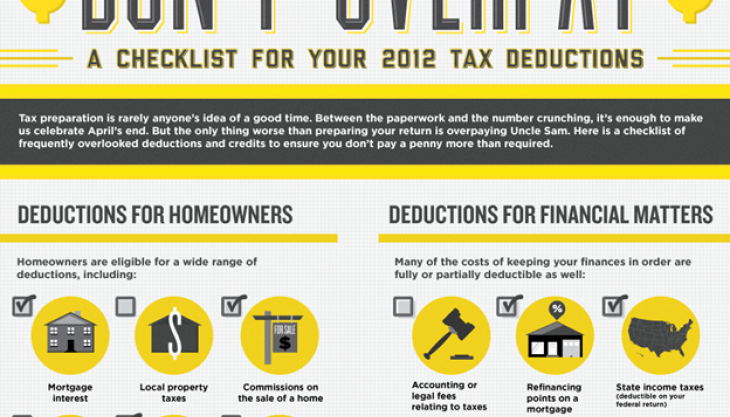

Image source: lemon.com

When the Return was Filed. In addition, the tax debt must be for returns that were actually filed at least two years before the date of your bankruptcy filing, using the date of the return as the starting point. As an example, let’s say you owed $8,000 in taxes on your 2007 return, but you didn’t actually file that return until June 14, 2009. The earliest date you could include that tax debt in a bankruptcy filing would be June 15, 2011.

When the Tax was Assessed. The IRS assesses taxes on specific dates, either because you self-reported taxes due, the IRS has made a final determination based on an audit, or the IRS has proposed an assessment that has become final. For example, if the IRS audits you and finds that you owe back taxes for various years because of mistakes on your returns, you cannot include those assessed taxes in a bankruptcy unless at least 240 days after the IRS’ assessment. Also, if you don’t file a return, the IRS can take the information they do have (W2 forms, 1099 forms, etc.) to essentially take a guess at your income and assess taxes accordingly.

The Return was Legitimate. The tax return in question cannot be fraudulent or frivolous.

Tax Evasion. The taxpayer cannot be guilty for intentionally trying to evade tax laws.

Those are the basic five conditions for including tax debt in your bankruptcy filing. That means that you can’t include taxes if you didn’t actually file a return. Also realize that when you go to file for bankruptcy, you have to show that you’ve filed tax returns for the last four years. All such returns must have been filed by the date of the scheduled meeting with creditors. All of the above information would also apply to your state taxes as well.

Image source: addictinginfo.org

Armed with this knowledge, you should have a much clearer picture if any of your tax debt can be included in your bankruptcy filing. As always, discuss specific concerns with a qualified bankruptcy attorney who can advise you based on your individual circumstances and state laws that may impact your situation.

Dedicated to helping residents of North Carolina find the best solutions to their debt problems. Don’t waste another day worrying about your debt. Call +1-833-627-0115 today to schedule a free initial consultation to discuss your bankruptcy options.

Debts Hurt! Got debt? Need help? Get started below!

Serving All of North Carolina

- Bankruptcy Attorneys Raleigh NC (North)

- Bankruptcy Attorney Fayetteville NC

- Bankruptcy Attorney Durham NC

- Bankruptcy Attorneys Wilson NC

- Bankruptcy Attorneys Greensboro NC

- Bankruptcy Attorneys Southport NC

- Bankruptcy Attorneys Wilmington NC

Bankruptcy Attorneys Raleigh NC (North)

6616 Six Forks Rd #203 Raleigh, NC 27615 North Carolina

Tel: (919) 847-9750

Bankruptcy Attorney Fayetteville NC

2711 Breezewood Ave Fayetteville, NC 28303 North Carolina

Tel: (910) 323-2972

Bankruptcy Attorney Durham NC

1738 Hillandale Rd Suite D Durham, NC 27705 North Carolina

Tel: (919) 286-1695

Bankruptcy Attorneys Greensboro NC

2100 W Cornwallis Dr. STE O Greensboro, NC 27408 North Carolina

Tel: (336) 542-5993

Bankruptcy Attorneys Southport NC

116 N Howe St. Suite A Southport, NC 28461 North Carolina

Tel: (910) 218-8682

Bankruptcy Attorneys Wilmington NC

116 N. Howe Street, Suite A Southport, NC 28461 North Carolina

Tel: (910) 447-2987